Material Legacy

We have material possessions that we want to pass on or donate to who we feel, will use it to further their life for the better.

podcasts

Monthly Podcasts to help you pass on what you worked for. This Month is from Merrill Lynch

Wills vs. Trusts: An Overview

Trusts are legal arrangements that protect assets and direct their use and disposition in accordance with their owners’ intentions. While wills take effect upon death, trusts may be used both during the life and after the death of their creators. Separately or together, wills and trusts can serve effective estate planning. From Investopedia

choosing Financial Advisor

Choosing a good financial advisor can help you avoid these costs and focus on your goals. Financial advisors aren’t just for rich people working with a financial advisor is a great choice for anyone who wants to get their personal finances on track and set long-term objectives. To find the ideal financial advisor for your requirements, consider following our 5 key steps.

Lifetime Limit

For 2023, the lifetime gift tax exemption as $12.92 million. This means that you can give up to $12.92 million in gifts over the course of your lifetime without ever having to pay gift tax on it. For married couples, both spouses get the $12.92 million exemption. This means that if you are married, you and your spouse could give away a total of $25.84 million before paying the gift tax. However, due to changes in federal law, the lifetime gift tax exemption is scheduled to shrink over a multi-year period during the early 2020s. In fact, the exemption will drop to $6 million by 2026.

Reverse mortgage advice from the ftc

With a reverse mortgage, you borrow money from the lender, based on the amount of equity you have in your home. The lender may send you the funds from the reverse mortgage in one lump sum payment, a series of monthly payments, or some combination of those. But no matter how the money gets distributed to you, the lender adds interest each month to the balance you owe (the principal). That means your balance goes up over time, increasing the amount you have to pay, and you have less and less equity in your home.

personal liability insurance

Personal liability occurs in the event an accident, in or out of your home, that results in bodily injury or property damage that you are held legally responsible for. Personal liability claims could include medical bills, legal fees and more if a guest is injured on your property, as well as coverage for accidental damage you are legally responsible for on someone else’s property. If you have personal liability coverage, you may be able to avoid paying out of pocket for incidents like these, up to your coverage limits.

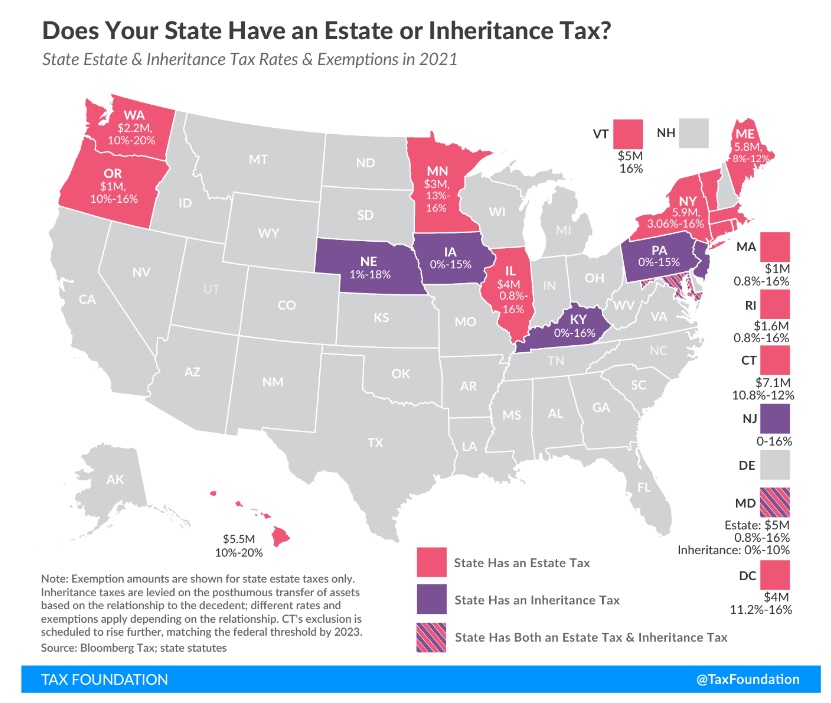

Definition

An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. Unlike the federal estate tax, the beneficiary of the property is responsible for paying the tax, not the estate.

WARNING

Any advice gleaned here needs to be filtered through your financial professional Adviser. To make it simple, the IRS is a complicated beast that grows in ways even the professionals have trouble understanding.